Mortgage calculator with extra payments monthly and annually

A monthly mortgage payment is made up of many different costs. For instance if you take a 51 ARM the rate starts off low and you pay the same mortgage payments for the first five years.

Biweekly Mortgage Calculator

Because its a fixed payment schedule if you factor in additional payments you can actually reduce your payment time.

. Such as monthly or annually. Longer loans mean lower monthly car payments which is important when youre looking at 25000 or more for even a basic new vehicle. In some countries payments are due monthly but interest might compound in other periods.

For a 15-year FRM thats 180 monthly payments throughout 15 years. Extra payments can possibly lower overall interest costs dramatically. 3X to 45X Annual Income.

Principal and interest PI homeowners insurance property taxes and private mortgage insurance PMI. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

Is approaching 400000 and interest rates are hovering around 3. The home loan calculator accounts for mortgage rates loan term down payment more. Added to this are the following costs.

Mortgage Closing Date - also called the loan origination date or start date. That equals 13 monthly payments annually totaling 15600. Our mortgage calculator helps you estimate your monthly mortgage payments.

Download FREE Mortgage Payoff Calculator with Extra Payment Excel template. The calculator will not recognize overlapping payments of the same frequency. Free fast and easy to use online.

To make it easier you can time this when you get large work bonuses or tax returns within the year. Use our free mortgage calculator to estimate your monthly mortgage payments. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency.

Lenders typically like to see borrowers put at least 5 down on their property. Mortgages with or without additional payments. When borrowers put down less than 5 they are typically charged a significantly higher interest rate to offset the additional risk the lender is taking.

Your mortgage can require. After the initial teaser period the rate changes annually. Input only few values.

When you change to biweekly payments youll make payments every two weeks. It includes advanced features like amortization tables and the ability to calculate a loan including property taxes homeowners insurance property mortgage insurance. For example a one-time additional.

If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. Unfortunately those affordable monthly payments cost you money over the long run. Account for interest rates and break down payments in an easy to use amortization schedule.

This payment method can cut years. Our calculator above can estimate other payment schedules such as weekly quarterly and annual payments. This tool allows you to calculate your monthly home loan payments using various loan terms interest rates and loan amounts.

Because some months are longer than others youll end up making an extra mortgage payment each year. A good used car can easily run 10000 or more. Well explain how you can this below.

For example if you want to make an extra monthly payment of 100 during months 1-9 and an extra payment of 400. The tax rate is based on an assessment of the propertys value. Besides monthly mortgage payments you can choose a bi-weekly payment schedule.

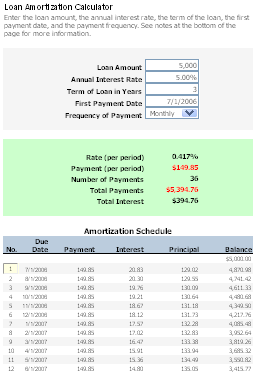

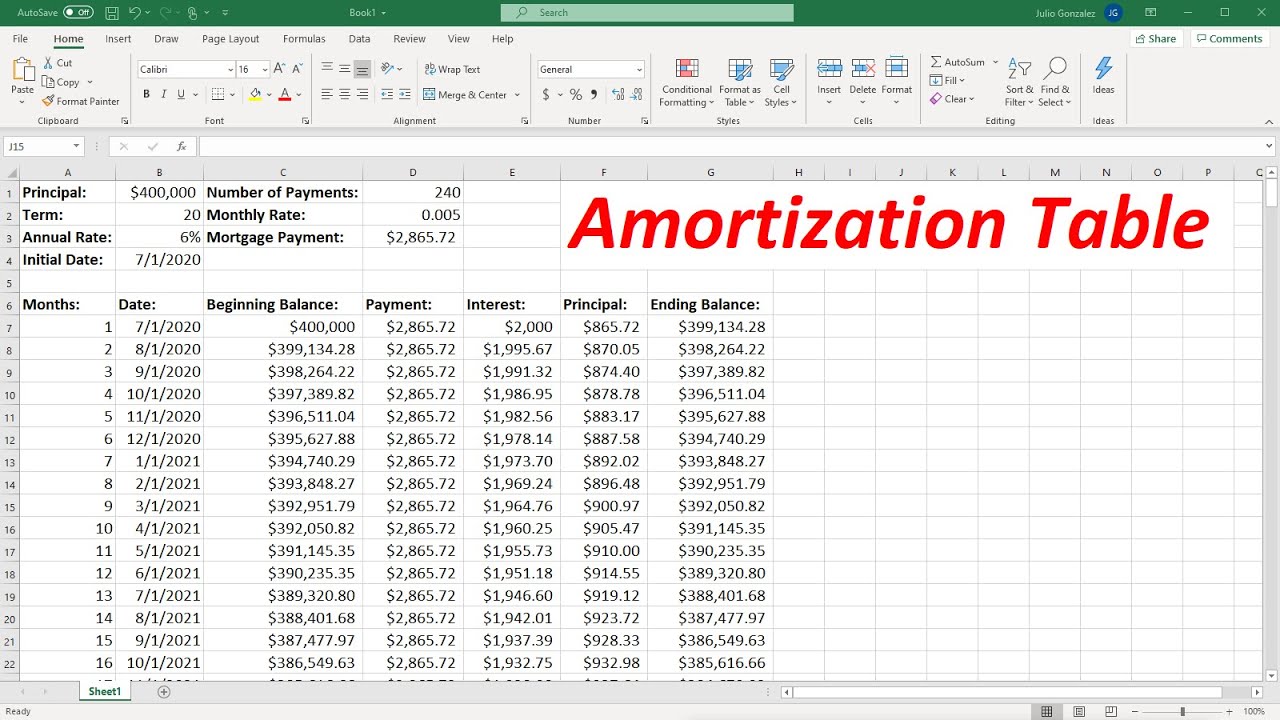

The loans monthly principal and interest can be calculated from this information. If additional payments are made interest savings and reduction in length of loan are calculated. First Payment Due - due date for the first payment.

Our mortgage calculators payment breakdown can show you exactly where your estimated payment will go. The calculator will not recognize overlapping payments of the same frequency. Fortnightly payments follow the 52-week calendar year instead of the 12-month timetable.

The nationwide average is about 2470 annually or just over 12 of the. If additional payments are made interest savings and reduction in length of loan are calculated. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US.

Because you make payments every 2 weeks this results in 26 half payments which is equivalent to 13 monthly mortgage payments. Extra Mortgage Payment Calculator 47. Mortgages with or without additional payments.

This means higher mortgage payments once interest rates increase. If the borrower starts making the extra payments early enough and for an amount thats not exceptionally large it is possible to save tens of thousands of dollars on a 200000 mortgage the average size new mortgage balance as of 2017 according to the Consumer Financial Protection Bureau was 260386. This is broken into monthly installments and added to your monthly mortgage payment.

If you used to pay 1200 dollars a month youll pay 600 every two weeks instead. Learn the benefits and disadvantages of paying off your mortgage faster. Interest Compounding Frequency has options.

Most homeowners normally make monthly mortgage payments which is equivalent to 12 payments annually. For example if you want to make an extra monthly payment of 100 during months 1-9 and an extra payment of 400. This strategy takes advantage of the 52-week schedule in the.

Found on the Set Dates or XPmts tab. To pay extra on your mortgage you can make an additional 13th payment. Lets say you would like to make extra monthly principal payments of 11612 to round the payment to 1100 for the next 10 years starting in July of 2019.

Mortgage Amount or current balance. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Most policies are billed annually so the calculator divides by 12 to get a monthly cost.

How Much Will My Monthly Mortgage Payments Be. For example in Canada mortgage loan payment is monthly but the interest rate is compounded semi-annually. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in full.

Loan Calculator with Extra Payments - Get an amortization schedule showing extra monthly quarterly semiannual annual or one-time-only payments. The table below compares a loan with one that makes an extra mortgage payment annually. The example above accounts for monthly payments.

Easily calculate your savings and payoff date by making extra mortgage payments. Longer loans mean a lower monthly payment and a more affordable vehicle. Before taking a fortnightly option be sure to arrange it with your lender first.

Mortgage loan basics Basic concepts and legal regulation. ARMs usually come in 31 ARM 51 ARM or 101 ARM. So for a 250000 loan mortgage insurance would cost around 1250-3750 annually or 100-315 per month.

Loan Repayment Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Extra Payment Calculator Is It The Right Thing To Do

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free Loan Amortization Calculator For Car And Mortgage

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

How To Create An Amortization Table In Excel Youtube

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator How Much Will You Save

Mortgage With Extra Payments Calculator

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage